CEYRON - BOUNTY

What is Ceyron?

Ceyron is a decentralized exchange system that wants to increase the liquidity of cryptographic assets more transparent and secure than the centralized counterparts currently on the market. Ceyron is an ecosystem built and operated by a network of popular partners around the world in a centralized network. The goal is to provide an appropriate financial experience worldwide by using the power of chain block technology. Ceyron has a simple and sustainable transaction-based business model. Every trader makes a profit from the transaction.

Identify the Problem

The problem Ceyron wants to solve is summarized below. According to this,

Low banking rates

The African economy is highly liquidated and has a very poor financial footprint. Less than 10% of adults have bank accounts. The market returns with cash transactions. For example, more than 85% of trade is cash.

A highly competitive market

The mobile money environment in Africa is becoming increasingly competitive. This increased competition means that consumers have more choices.

Very low usage rates

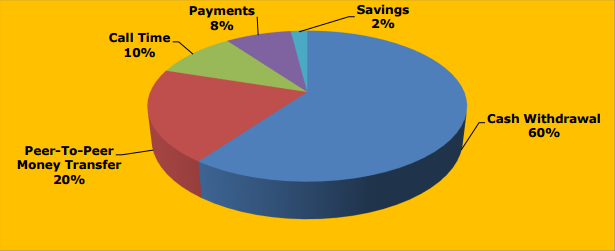

In Africa, 12% of account holders exist in the world. But the level of inclusion in the financial system is very low. The average behavior analysis of paying users resembles a general trend: withdrawals representing at least 60% of the volume of transactions; peer-to-peer transaction 20%; 10% call duration, 8% payment and 2% savings.

Use of low debit cards.

Prepaid debit cards are only used for POS shopping and services (rarely). However, the owner of the CEY symbol has the privilege of receiving an annual dividend on a CFL card.

Lack of credit is safe and precarious for loan applicants.

In Africa, there is a lack of credit available to most applicants. CFL intends to solve this. More specifically, the CEY symbol can be considered a source of income distributed to entrepreneurs, as it deserves credit.

Lack of stable and sustainable income for loan applicants There is a stable and sustainable income deficit

in loan applications in Africa. With all of the above, it is clear what the problem is.

CFL Solutions

CFL Credit Portfolio Fund, Colombus Investment Management Ltd. and the main asset is a loan asset purchased from a non-bank origin. Assets consist of mortgages, second mortgages, real estate bridge loans, motor vehicle loans, equipment and lease lending, commercial mortgage loans, asset-based loans and factoring contracts. Non-bank financial institutions establish credit assets and generally retain all service responsibilities. The Fund will, from time to time, purchase credit assets in the pool, in all separate credits or in all participation towards credit. In addition to paying a nominal service fee to fulfill the billing function and billing of a typical creative credit asset receiver, the loan will continue to be the primary service provider of the transfer of resources, including the obligation to provide special services if the collateral is granted. This loan is up to date and fully replaced. In addition to the service functions provided by the credit creator, if one or more creators are unable to perform their work, a secondary "backup" service task is enabled. This ensures that cash collection and repayment of credit assets continue. Currently, 60 percent of US mortgage loans are held by banks for 30 percent (30 percent) by 2013. This is held on the bank credit platform of hundreds of US trillion trillions of US banks alone in the US mortgage. The Investment Manager must approve the payment of debts and risks associated with the platform itself and should notify the credit profile of the asset, origin, volume, coverage, time and cost as per the rules, management quality and service quality. Fund Managers will be tasked with selecting the highest performing assets available on this platform for the CFL portfolio, as well as liquidating the highest risk assets of the CFL portfolio. The solution Jeyran brought here

Simple and Fast

You can easily send Ceyron as an email. When there is no point where you live, Ceyron can send and receive.

We

use Decentralized Blocking Chain technology that is decentralized , so there is no reliable third party. Transactions made directly between users.

Unlimited

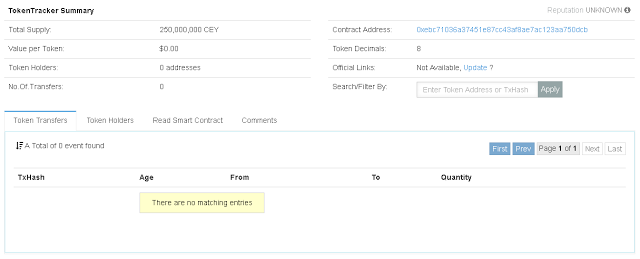

Ceyron will only supply 250 million dollars. For this reason, prices are on an upward trend when demand is high and the amount of funds remaining does not increase.

Recommended Jeyran solution for this problem

It is worth it.

From the moment you win CEY, the world is open to you.

Ceyron changed.

The private Ceyron exchange site allows you to buy and sell CEY and other crypto currencies.

Travel Spending

Without stopping. Your card will always be considered a local currency card and you will get the perfect interbank rate.

Anonymous

Anyone can run their wallets and act the same anonymously like Bitcoin.

Easy Money Transfer

Just like Bitcoin, you can send whatever you want, wherever you want.

There is no obstacle to

sending and receiving international payments without participant participation.

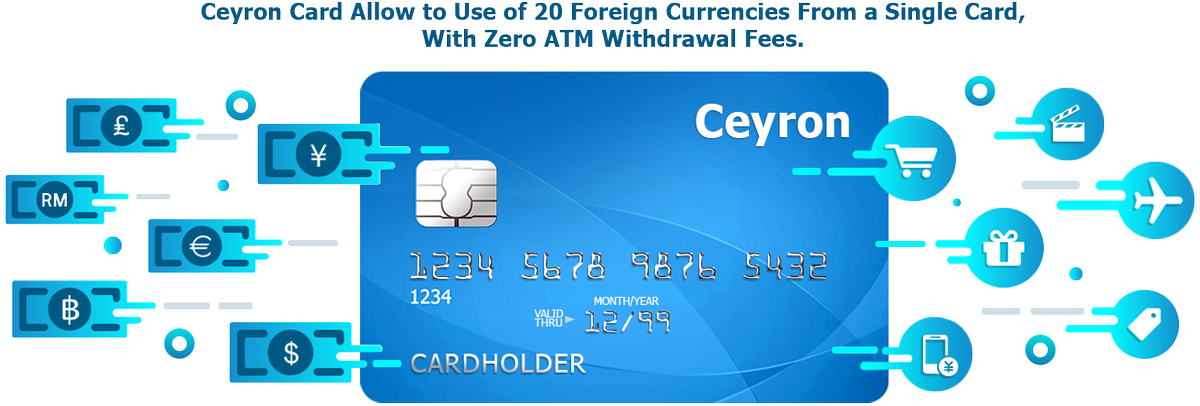

CEY Card

The CEY card will become a physical, virtual and debit MasterCard with a mobile application that allows you to use 20 (20) foreign currencies from one card. CFL can save customers up to 70% (70%) for these costs. The currency can be exchanged at any point of sale (the average for the industry is 3.75% vs. 3% for CFL), as well as through applications. In addition, unlike the standard 1.5 percent fee for withdrawing ATMs, CFL will not assess the withdrawal fees. The CFL mobile application will contain additional functionality to transfer funds in the currency between traders, as well as friends and family accounts, thereby earning money at zero percent (0%).

Bank card Ceyron

The card comes with the most automatic CHIP functions and technology. What is CHIP (also known as EMV) is a technology that makes your bank card more secure and difficult to copy or copy. Using a CHIP card, confidential information is much safer than the ancient technology of magnetic strips and card issuers; For example, if you buy something, you are faster, safer and safer. This technology is standardized all over the world, and your CHIP debit card can be used anywhere (if accepted by Mastercard) and is compatible.

Effective debit cards are effective

Account holders can choose cryptography that can be used as a proposal, and when initiating a transaction (for example, dinner at a price of $ 83.65), a prepaid debit will be used, or the Holder can select a supported crypto currency, which will then be sold at a fixed price for Complete the transaction.

CFL and Blockchain

Cryptocurrency (or crypto currency) is a digital asset designed to act as an exchange medium that uses cryptography to support transactions, to manage the creation of additional blocks, and to verify the transfer of assets.

Strategic alliance

Strategic alliance CFL is a recognized leader in the field of block, financial and banking technologies.CFL intends to sign a service agreement with Coinfirm.io regarding the KYC / AML (Anti Money Laundering) verification for each application of the token holder. Ambisafe is a pioneer in blockchain technology and ICO, which has helped the world become more decentralized since 2010. Their work is crucial for projects such as Tether and Bitfinex. Recently, Ambisafe is behind the success of the ICO. Loyal Bank is a bank registered under the laws of Saint Vincent and the Grenadines. Loan Portfolio

Currently, sixty percent (60%) of US mortgage loans belong to non-banks, compared to thirty percent (30%) in 2013. More than three trillion US dollars in the US are available mortgage loans to select hundreds of banking credit platforms. The Fund Manager is responsible for approving the solvency and risks associated with the platform and determining the credit profile of the assets issued, compliance with regulatory requirements regarding origin, scope, guarantee, duration and speed, quality of management and service. Fund managers will be responsible for selecting the assets of the best performers available on this platform for the CFL portfolio, and for cleaning the most risky assets in the CFL portfolio.

Sale and distribution of tokens Ceyron (Cey)

The symbol CEY is a functional intellectual contract in the fund. The CEY symbol is not returned. The CEY symbol is not intended for speculative investments. Future performance or value will not be promised or made available in connection with CEY documents, including the promise of in-kind value, no current payment obligations, and there is no guarantee that the CEI document is of particular importance. CEY rights are not securities and do not bear any costs to the Company. The CEY symbol is not eligible for the company.

The CEI Stock Exchange is a digital marker provided to investors and represents an ownership interest in a separate class of shares that does not vote for Ceyron. The official name of the Representative is provided by Loyal Agency & Trust Corp. ("LATK" or "Candidate") are considered secretly for iconic owners, and marketers will have a useful interest in Ceyron Finance Ltd. there is. are not included in the administration or activities of the fund manager or fund described below.

The CEY icon is an intellectual digital sign of the contract that represents the ownership of the profitable extraordinary CEY fund held by Loyal Agency & Trust Corp, which is trusted with the presence of a CEY marker.

CEYRON(CEY) TOKEN SALE

CEY Tokens are functional utility smart contracts within the Fund. CEY Tokens are non-refundable. CEY Tokens are not for speculative investment. No promises of future performance or value are or will be made with respect to CEY Tokens, including no promise of inherent value, no promise of continuing payments, and no guarantee that CEY Tokens will hold any particular value. CEY Tokens are not securities and are not a participation in the Company. CEY Tokens hold no rights in the Company.

CEY Tokens are digital tokens that will be issued to the investor(s) and represent beneficial ownership interests in a separate class of non-voting equity shares in Ceyron. Legal title of the tokens will be held in trust by Loyal Agency & Trust Corp (“LATC” or the “Nominee”) for the token holders, and token holders will hold a beneficial interest in Ceyron Finance Ltd. The Nominee is independent of and not involved in the management or operation of the Fund or Fund Manager described below.

Offering: CEY Token – An Ethereum-based smart contract digital token representing beneficial ownership in non-voting shares in CEY, which will be held by Loyal Agency & Trust Corp in trust for the holders of the CEY Tokens.

Token Name: Ceyron

Token Symbol: CEY

. Decimals: 8

. Price Per Token: $0.10 USD per CEY Token

. Number of Tokens for Sale: 250,000,000

. Start of Token Pre-Sale: 2/16/18

. End of Token Pre-Sale: 3/15/18

. Pre-Sale Discount: 25%, 15%, 5%

. Start of Token Sale:3/16/18

. Soft Cap: 2 Million USD

. Hard Cap: 45 Million USD

Start of Bounty Registration: 02/15/2018

End of Token Sale: When Hard cap is reached

Currencies Accepted: BTC, ETH, LTC, PayPal and Credit/Debit card

PS: Each of the times and dates in the above timetable is subject to change at the absolute discretion of CFL.

CEYRON TOKEN VALUE

TEAM

|

For more information, please visit the link below:

Website:https://ceyron.io/

Instagram:https://www.instagram.com/ceyronico/

Facebook:https://www.facebook.com/Ceyron/

White paper:https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

AUTHOR: adam sukses

profile:https://bitcointalk.org/index.php?action=profile;u=1958433

Komentar

Posting Komentar