✅ INTRODUCTION UNICAP FUND (CETF) & DEFI BANK ✅

Introduction

As a new crypto ecosystem recently, DeFi's popularity is on the rise. In essence, DeFi was designed in such a way as to create a decentralized financial system. By leveraging Blockchain, the DeFi ecosystem is attracting more and more investors.

DeFi-related assets are getting more attention

Although it seems that leading crypto assets such as BTC and ETH have continued to experience low volatility in recent days, a large number of DeFi-related assets have managed to attract the attention of many crypto investors, thereby propelling this digital coin to record highs.

In terms of definition, DeFi itself means 'decentralized finance'. By definition, DeFi is a crypto ecosystem consisting of financial applications designed on leading Blockchain platforms.

Using DeFi technology, one can build smart contracts with code that facilitate intermediary actions, including managing and accepting deposits, handling secured loans, and liquidating collateralized assets according to the terms of the contract if their value fluctuates.

Have you heard of Exchange Traded Fund (ETF)?

Exchange Traded Fund (ETF) is a mutual fund that is like stocks. This instrument is in the form of a collective investment contract that can be traded on a stock exchange. This product has unique codes like the issuer. However, ETFs are issued by investment managers just like mutual funds.

ETF investments are collections of tens, hundreds, or sometimes thousands of stocks or bonds in one fund. ETF investment instruments allow you to buy and sell a basket of assets without having to buy or sell all components separately.

ETF or exchange-traded fund is an investment option in the trading world that is in demand by different people because the process is fast and cheap and the operation is entirely based on arbitrage, which minimizes risk. In the crypto space, there is a CETF or crypto exchange fund, which is almost the same as an ETF, with the only difference that it only uses crypto assets. One of the projects carrying the CETF concept is Unicap, which is a Blockchain-based project that is a combination of DeFi and CETF.

Website: https://ucap.finance/

Introduction Unicap

Unicap is a Blockchain technology based platform that combines CETF and DeFi, the Unicap platform offers various advantages, especially ETF based CETF (Exchange Traded Funds), thereby providing users with investment options with minimal risk and a reliable scheme, and at the same time combined with the DeFi concept, which allows various decentralized financial processes to be used on its platform. Their platform uses a real-time interest rate modeling algorithm in which the interest rate is automatically adjusted according to changes in supply and demand as the market moves, providing the best rate for its users.

The Unicap platform creates a new and robust DeFi ecosystem when compared to other platforms, providing investors with the opportunity to benefit from unused crypto assets, which of course gives investors the opportunity to increase profits and generate stable passive income from unused crypto assets. used (collective investment). In addition, Unicap also combines it with the DeFi protocol, which is a deposit and lending protocol that uses digital cryptocurrency, where their platform supports deposits, withdrawals, and borrowing and payments at any time using crypto assets. Using the Ethereum Blockchain technology so that it can go through an automated procedure using the smart contract function that applies to the Ethereum Blockchain system,

What is UCAP token?

This token is based on Blockchain technology and is the primary transaction tool for every transaction in the Unicap ecosystem. Based on Ethereum Blockchain technology, UCAP can be used for a variety of purposes such as borrowing, lending, trading, etc., Automatically through smart contracts on the Ethereum network, providing transparency and without the need for a third party. Initially, the UCAP token will be backed by major cryptocurrencies and good liquidity. In the future, Unicap will also carry out buybacks in several stages after meeting various criteria.

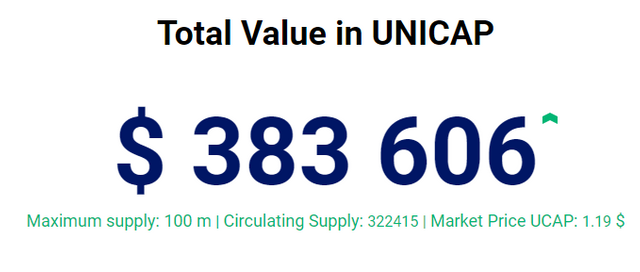

UNICAP Token

● Token Ticker: UCAP

● Token Type: ERC-20

● Blockchain: Ethereum

● Legal Classification: Utility Token

● Total Supply (No. of Tokens): 100,000,000

Private Swap: 250,000 UCAP (0.20%) at USD 0.8 per UCAP

● Pre Public Swap Level 1: 300,000 UCAP (0.30%) at USD 0.8 – 1 per UCAP

● Pre Public Swap Level 2: 500,000 UCAP (0.50%) at USD 0.9 – 1.1 per UCAP

● Pre Public Swap Level 3: 500,000 UCAP (0.50%) at USD 1 – 1.2 per UCAP

● Sale Level 4: 500,000 UCAP (1%) at USD 1.1 – 1.3 per UCAP

● Sale Level 5: 500,000 UCAP (1%) at USD 1.2 – 1.4 per UCAP

● Sale Level 6: 1,000,000 UCAP (1%) at USD 1.3 – 1.5 per UCAP

● Sale Level 7-100: 1,000,000 UCAP (1%) each level at USD 1.4 – 20 per UCAP

Website: https://ucap.finance/

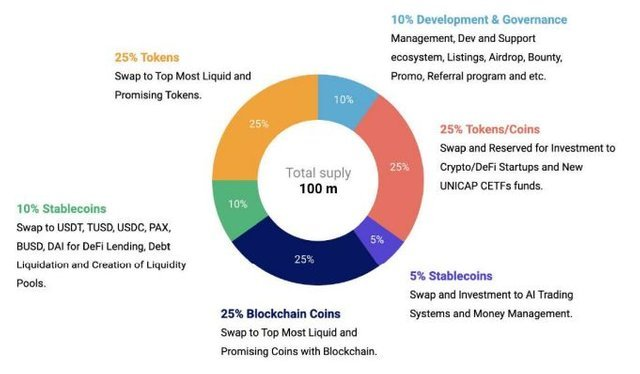

UNICAP Fund DeFi Ecosystem

Pre Public Swap Token Offering 1 UCAP = 1–1.5$

● 10% Development & Governance

Management, Dev and Support ecosystem, Listings, Airdrop, Bounty, Promo, Referral program and etc.

● 25% Tokens/Coins

Swap and Reserved for Investment to Crypto/DeFi Startups and New UNICAP CETFs funds.

● 5% Stablecoins

Swap and Investment to AI Trading Systems and Money Management.

● 25% Tokens

Swap to Top Most Liquid and Promising Tokens.

● 10% Stablecoins

Swap to USDT, TUSD, USDC, PAX, BUSD, DAI for DeFi Lending, Debt Liquidation and Creation of Liquidity Pools.

● 25% Blockchain Coins

Swap to Top Most Liquid and Promising Coins with Blockchain.

Token Address:0xbaA70614C7AAfB568a93E62a98D55696bcc85DFE

Roadmap

Q3 2020

Idea Generation. CETF & DeFi product research. Brainstorming. Team forming, Creation of UNICAP.finance

Q4 2020

Site development. Opening of Investor Personal Account (14 languages), Deployment of Smart contract and mining tokens UCAP.

Pre public swap tokens offering. Unicap Global community development. Promo/Airdrop/Bounty.

Q1 2021

DeFi Bank product design and prototype. Swap tokens. Listing token on KuCoin/Bittrex/FTX/Exmo/Lbank. AirDrop for DeFi community. New Funds Develop and Launch. 1st Global community survey.

Q2 2021

UNICAP DeFi Bank v1 Launch, New Funds Development and launch. Swap of tokens. Listing OKEX, HUOBI, BINANCE. Acceptance of funding proposals for Crypto/DeFi startups.

Q3 2021

UNICAP DeFi Bank v2 (new protocols) Launch. New Funds Develop and Launch. Listings New Funds.

Q4 2021

UNICAP New Startups Launch. Listings Startups on OKEX/HUOBI/BINANCE.

#ETF #Ethereum #bitcoin #eth #uniswap #defi #gem #investing #altcoins #exchange #money #cryptocurrency #trading #investment #decentralized.

MORE INFORMATION :

Website : https://ucap.finance/

Whitepaper : https://ucap.finance/docs/ucap_wp_v1.pdf

Facebook : https://facebook.com/swaprsfair

Twitter : https://twitter.com/unicapfinance

Telegram : https://t.me/unicapfinance

Discord : https://discord.gg/BJBA4Yb

ANN Thread : https://bitcointalk.org/index.php?topic=5278941

adam sukses

Bitcointalk profile : https://bitcointalk.org/index.php?action=profile;u=1958433

ETH : 0x5f3f4Bb6EA24D1B188Ee0457a5B807D5fbf043A0

Telegram : @adamsukses

Komentar

Posting Komentar